4 Strategies for securing capital in the Indian EdTech industry

Fri Jan 27 2023

3 min read

From fin-tech & D2C, to entrepreneurship & investing, Kaleidoscope is Klub's take on the how's and why's of the finance, investment, & D2C worlds.

A quarter of India’s population is under the age of 15 while a little over 50% of India is under the age of 29. A young nation with rising accessibility to technology and aspiration makes the Indian market ripe for the edtech sector. It’s no surprise the edtech industry is rapidly growing and from the current market size of ~$800 mn, it is expected to be a $30 bn industry in the next 10 years!

Edtech is a capital-intensive business and requires large edtech funding, including debt capital, for startups to build products, meet marketing and operational expenses, acquisitions, and for every other business function required to build a successful organisation. Here’s an insight into the funding raised by major edtech companies in India.

Edtech startup funding of key players:

- Byju’s: $2.2 bn

- Unacademy: $398.5 mn

- Vedantu: $203.2 mn

- Toppr: $110.8 mn

- Simplilearn: $28 mn

Source: Leadsquared

What are the various ways to raise capital for Edtech companies in India?

1. Angel Investment

India’s home to 26,500+ angel investors! A rapid rise from just a handful of investors not long ago. Several of these angel investors do provide business loans for startups, however, most angel investments are small ticket sizes. It’s ideal for startups that are in the early stages but not suitable for edtech startups looking to raise a large round.

Pros:

- Benefit from the expertise and guidance of angel investors.

- Pre-revenue and early-stage edtech businesses may raise funding via this route.

Cons:

- May require giving up large equity.

- Raising a large quantum of capital might not be possible through angel investors as their cheque sizes are generally smaller.

2. Bank Loans

A traditional way to raise debt capital. Bank Loans are suitable for companies with assets on books. If your edtech company runs offline centres, you may be able to get bank loans but will find it difficult to raise bank loans if your edtech business is completely online.

Pros:

- No equity dilution.

- Lets you raise both small and large amounts of capital.

Cons:

- Suitable for asset-rich companies. Edtech companies with an asset-light model may find it difficult to raise bank loans.

- Lengthy paperwork.

- Fixed EMIs.

- Not suitable for new edtech businesses.

- Not suitable for loss-making edtech companies.

3. Equity Funding

A popular way of fundraising adopted by many edtech companies, involving both debt capital & equity. Edtech is the third most funded segment in the Indian startup sector and is behind only e-commerce and fintech. Sequoia, Silver Lake, Nexus Venture Partners, BlackRock, Naspers Ventures, General Atlantic, and Tiger Global are some of the major investors in the Indian edtech sector, including venture debt funds.

Pros:

- Access to large capital.

- Companies that are loss-making currently but offer bright future prospects can raise capital via this route too.

Cons:

- Post the sector has matured, newer companies will find it difficult to raise equity funding.

- Involves large equity dilution.

- Lengthy paperwork can take several months to close a deal.

4. Revenue Based Financing

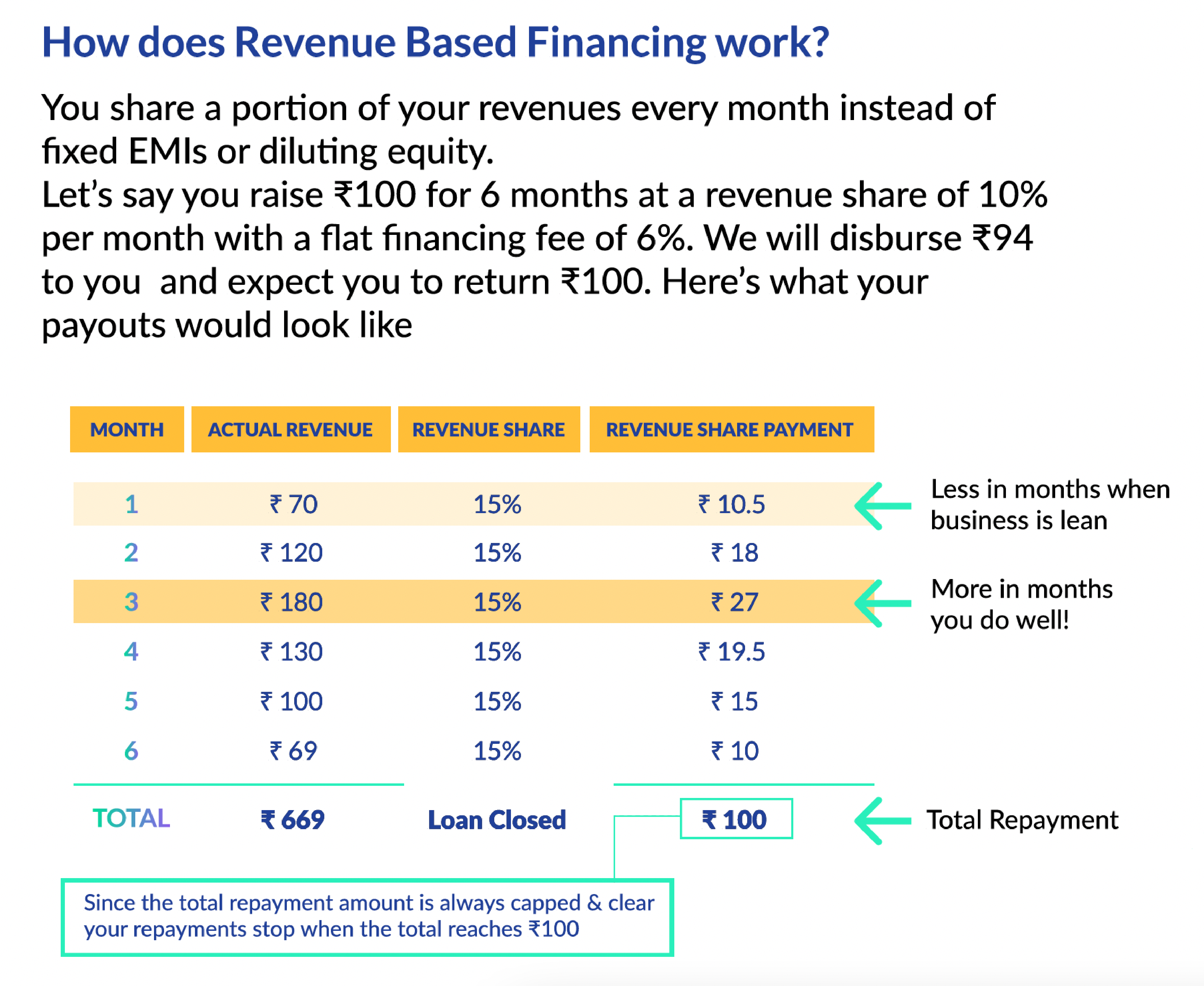

A faster, flexible, and founder-friendly approach to financing a business. Revenue Based Financing (RBF) lets you raise capital without the need to give up any equity or pay a fixed monthly instalment, making it a form of debt capital funding for startups.

Revenue Based Financing is most suitable to meet several costs like marketing, operational expenses, and expansion.

Pros:

- Fast - You can raise capital up to ₹30 Cr in just 48 hours!

- Flexible - There’s no obligation to pay fixed monthly instalments. Instead, you share a portion of your monthly revenue.

- Founder-friendly - Revenue Based Financing lets you raise capital without any equity dilution.

- Lets you raise multiple rounds frequently.

- No collateral requirement.

Cons:

- Not suitable for pre-revenue edtech companies.

Now that you’re familiar with various ways you can raise capital, including debt capital & equity, for your edtech business, you can choose the one that suits your business requirements the best. Alternatively, you can check the amount of capital you can raise with Klub here.