1 problem, 6 solutions - Financial Planning made easy 👇🏼

Mon Apr 17 2023

4 min read

India’s D2C and e-commerce brands are unleashing growth through a critical understanding of the market and consumers’ evolving preferences. As more and more Indians use the internet, revenues of e-commerce companies could triple over the next three years to 504 billion rupees ($8.13 billion). India now has the third most number of startups in the world, which means that in order to keep growing in competitive segments, doing what everyone does won’t cut it, and startup loans may be required to fulfil working capital needs.

Business tips for entrepreneurs:

— Nicolas Pizzo | The Techpreneur (@thenicolaspizzo) April 16, 2023

• Invest wisely

• Use social media

• Seek expert advice

• Do your own research

• Choose your market wisely

• Always measure and evaluate

• Showcase your area of expertise

• Deliver amazing customer service

Start building your empire now!

One way to maintain scalable growth is sound financial planning. We have done the homework for your brand. Here’s a checklist for you to keep handy while planning your finances for the new fiscal year 2023-24:

Growth comes with its own price tagsUsually, business financial planning gets misunderstood as plain old budgeting. That’s not true for cost-intensive D2C businesses that are investing money in brand building, user acquisitions and maximising conversions through repeat users. You should build an informed financial foundation by pre-planning heads like:

- Marketing expenditures - Events, performance marketing, influencer marketing, etc.

- Channel strategy - Marketplaces, own website, referral programs, offline sales through own stores/MBOs/convenience stores, etc.

- Strategic initiatives for brand building - Limited edition collections, partnerships, promotional sale events, etc.

💡 Pro Tip: Plan for Community Costs

Investing in growing & retaining your community can be a key component of your ecommerce business finance planning mood board. These costs include community managers, technical costs for website/app maintenance and the benefits you plan to extend to your members. Even a discount to community members or their referrals is a cost to you so do not “discount” the need to include that in your budget.

Read more about our take on community-building here: Klub on LinkedIn - Breaking down community

Double down on the cash cowFor D2C brands, it is important to monitor channels that drive repeat purchases because that brings in a large chunk of revenue. Maximising our revenues has to be the larger aim because this will fund your biggest costs: talent, expansion, and technology. For more than 74% of Indian D2C startups, repeat purchases happen either via the top 4-6 marketplaces or their own app/website. For the new fiscal year, invest in building an immersive experience on your app/website to drive retention and word of mouth.

Beware of the pit that is ADSWhile competitive segments like beauty & personal care, packaged food and beverages, fashion & accessories, etc. demand running ads and shelling out millions in performance marketing for user discovery, a little caution hurts nobody. Instead of burning cash on incessant advertising and performance marketing in dense categories without utilising data to improve targeting, brands can choose to spend on high-ROI avenues like events, influencer endorsements, intellectual property building, etc. There’s an easy 3 step approach recommended by industry experts for D2C brands which is:

- Leveraging first-party data to develop insights about your users and their lookalikes

- Use key levers like content, brand, and affinity to identify target audiences

- Create engaging content for this target audience

You can read more about recommendations for paid advertising here.

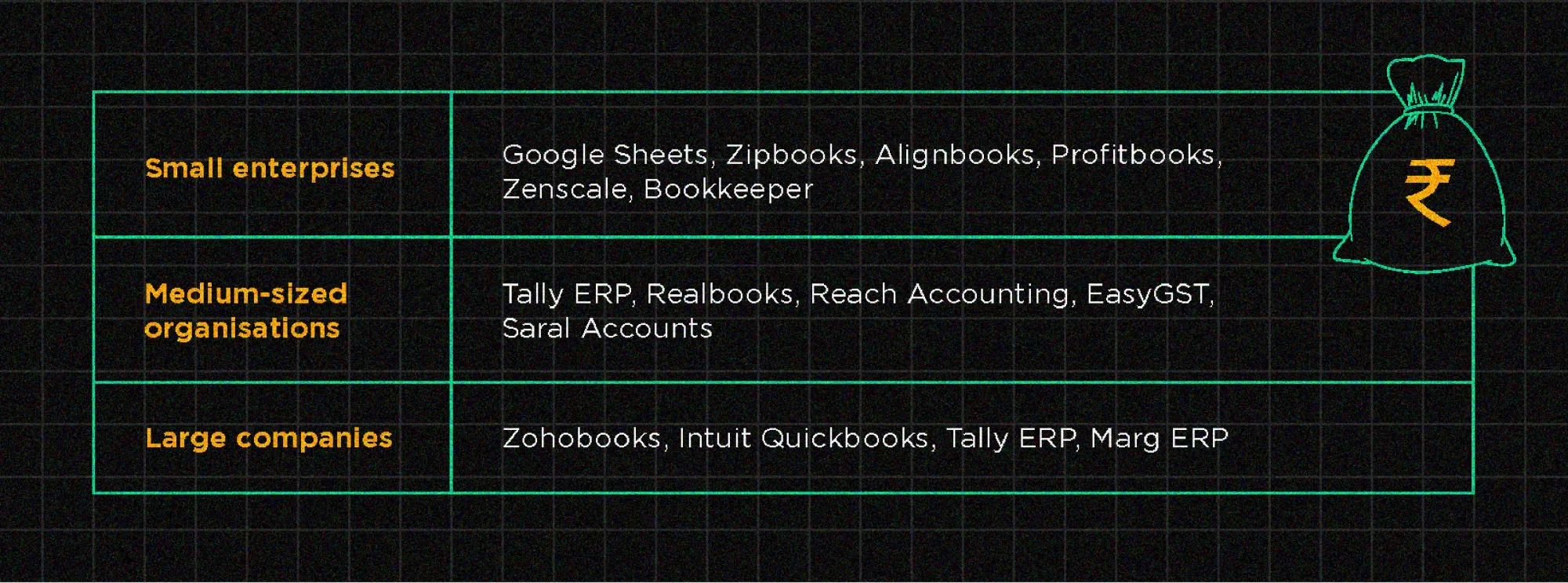

Invest in the right accounting toolInvesting in accounting software can help streamline financial processes and improve efficiency. Look for software that is tailored to startups in your segment, and that can automate tasks such as invoicing, expense tracking, and financial reporting. Using accounting software can help you streamline your accounting process and reduce the chances of errors. You can use any software from the options below to manage your financial records efficiently based on your size & needs:

Bake your cake & eat it too

When you plan for capital and fundraising, consider all the pros and cons around debt vs equity. Avoid giving up equity for use cases that can easily be funded through alternative sources that are backed by debt. In that case, you need to account for the costs of capital in the form of interest, yield & advisory fees in the case of 3rd party professionals.

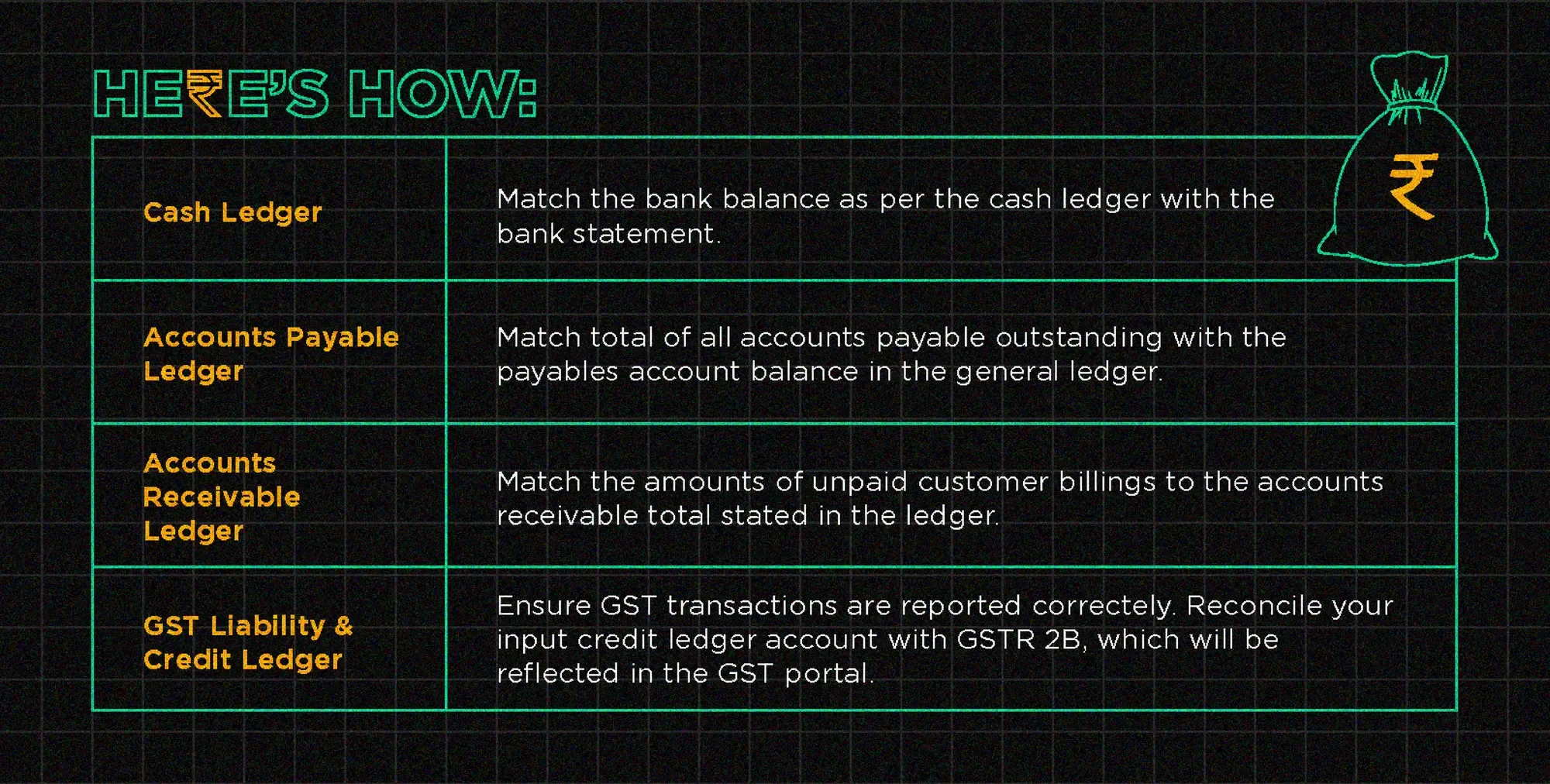

Maintaining financial hygiene is essential for all startups in India, particularly the young ones in dense segments like D2C. With the start of the new fiscal year 2024-2025, it's an excellent time to review your accounting procedures and implement the best practices for your organisation. For more information on debt funding for startups, join the Klub!