Deep Dives

Market Validation: A founder's epochal milestone

Thu Mar 04 2021

6 min read

We tend to have a limited view of startup journeys. Amidst all the noise about growth journeys & fundraises in the startup world, we forget to ask questions about the journey before entrepreneurship begins: How do founders get to a point where they can say, "okay, I think we're ready to translate this excellent idea into a real business now"? What are the questions they need to ask themselves before they get there? What are the pivotal serendipities along the way?

Anurakt & Ishita set out to build Klub, and along the way, went through a rigorous [now deeply insightful] process of iterations, feedback, and change to get to their milestones: market validation, and following it, a product-market fit. One year in, Klub is now on its way to becoming a thriving marketplace of brands & patrons enabling each other via revenue based financing. We dug deep, and broke down the journey into three main stages:

📍 Concept Validation

📍 Market Validation

📍 Product-Market Fit

Here's the story straight from Anurakt & Ishita:

On achieving concept validation

We have a firm belief that growth opportunities are found at the intersection of two large, thriving sectors. For us, these sectors were initially Fin-tech & Food, which later evolved into a Fin-tech & Consumer Brands. The early idea was to build a financing model for F&B brands in India, empowered by high-end services & a community driven rewards & access program. As great as this idea was, some of the most well-meaning mentors asked us a hard question: It's great to have a passion project, but how are you going to scale this?

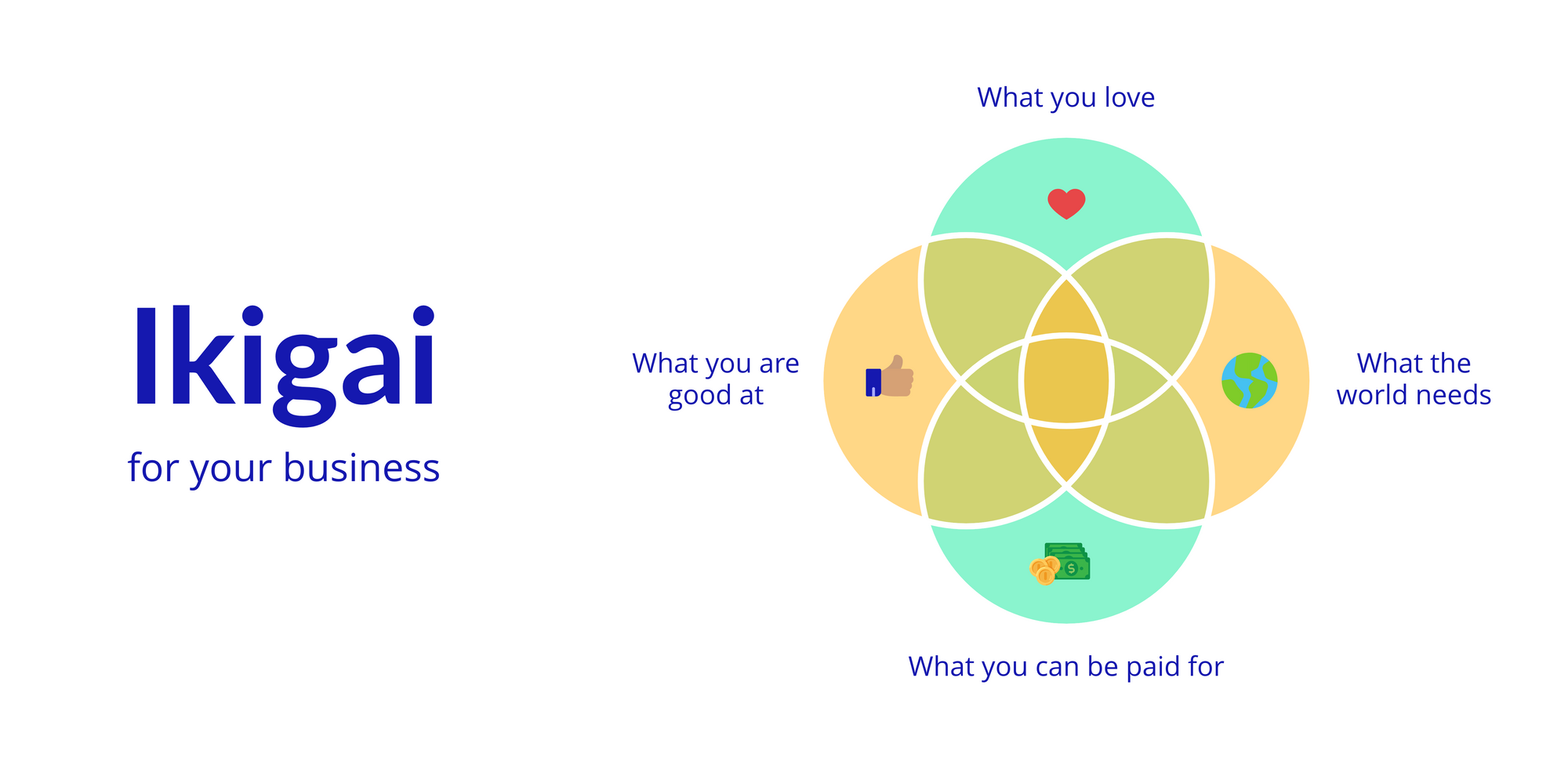

This pushed us to find the Ikigai of our business.

To find your Ikigai, ask yourself what you love doing, what the world needs, what you can be paid for, and what you're good at, with reference to your business.

We loved local F&B businesses, and the idea of bringing them together to create a community-led model. But when we asked ourselves [and the market] what the world needs, we realised there was a more pertinent need than what we had imagined - capital. We looked back on all our conversations with F&B businesses, and realised they all found it difficult to raise funds, and were largely ignored by traditional financing models. This was an aha! moment for us, given our finance backgrounds, which solved for 'what are you good at?'. Next, we had to figure out how we could turn this into a model which would enable monetisation. We had watched RBF being used as a financing model for SaaS businesses in the West, and revenue sharing is a thriving concept in the F&B space in India. So, excellent - we would utilise RBF to fund local businesses in India. But the difference between the US & Indian markets is this: there's a dearth of capital supply available in the east. How would we solve for capital supply in India? Enter: brand affinity. We realised that angel investors were excited about investment opportunities with brands they loved.

There, we had our Ikigai: providing flexible capital to loved local brands powered by the community.

How should entrepreneurs spot ideas that are likely to succeed, vs. ones that won't?

- Find your Ikigai.

- Swallow bitter pills early on. If there's a problem statement gnawing at you, take it on head-first. It's highly likely that you'll find your business idea there.

- Have clarity about your aspirations, and align them with your skill-set & resources.

- Find a balance between your aspirational concept and the current market reality.

- Do a lot of research! Extrapolate from existing models in the world. Then figure out how the models fit into the geographical context. GST was instrumental in enabling RBF for D2C businesses in India. Klub's model wouldn't have worked pre-digitisation.

- The process can be long, because it involves introspection, market research, and hard feedback from early mentors - but once you've found it, there's no looking back!

Now that the problem of concept validation had been solved, the next step was to get validation for the concept in the market.

Next stop: market validation!

Before you spend time & money on a product with extensive features, it's important to test the market with a Minimum Viable Product, or MVP. Start by defining what functionality your MVP will include. The idea is to build only what is needed to create enough value in the eyes of your target customer to validate that you are headed in the right direction. Based on feedback, iterate on new features to include, or improve old ones.

We had to build a product that would be scaleable, compliant, secure, and fair for both sides of the marketplace: the brands & the investors. In the phase post the pilot, Klub's product went through various rounds of iterations based on feedback from early users. We also ran a detailed market parity analysis [derived from Points of Parity to apply to a marketplace model] to optimise our offerings & pricing structures.

In December 2019, we ran a pilot version of the model with a local coffee chain in Bangalore - Third Wave Coffee Roasters. We chose to begin with a coffee chain since revenue sharing as a concept was well understood in the F&B space, and because Third Wave was the perfect fit for what Klub was building: it was a consumer brand with a thriving local community. [Third Wave Coffee Roasters went on to raise two additional rounds of RBF with us in the coming months.]

In August 2020 [peak Covid], we on-boarded our first set of brand partners, patrons, and NBFC's. By November 2020, we had proof of market validation: we had funded 45+ brands, and had on-boarded over 1500 patrons onto the platform, with excellent feedback on both sides of the marketplace!

Epochal milestone: achieved! What's next?

Early Product-Market Fit

Market validation confirms that your model works - but product-market fit demands proof of scalability. How do you determine if your product has achieved a product-market fit? Read this detailed guide on the concept, but to sum it up:

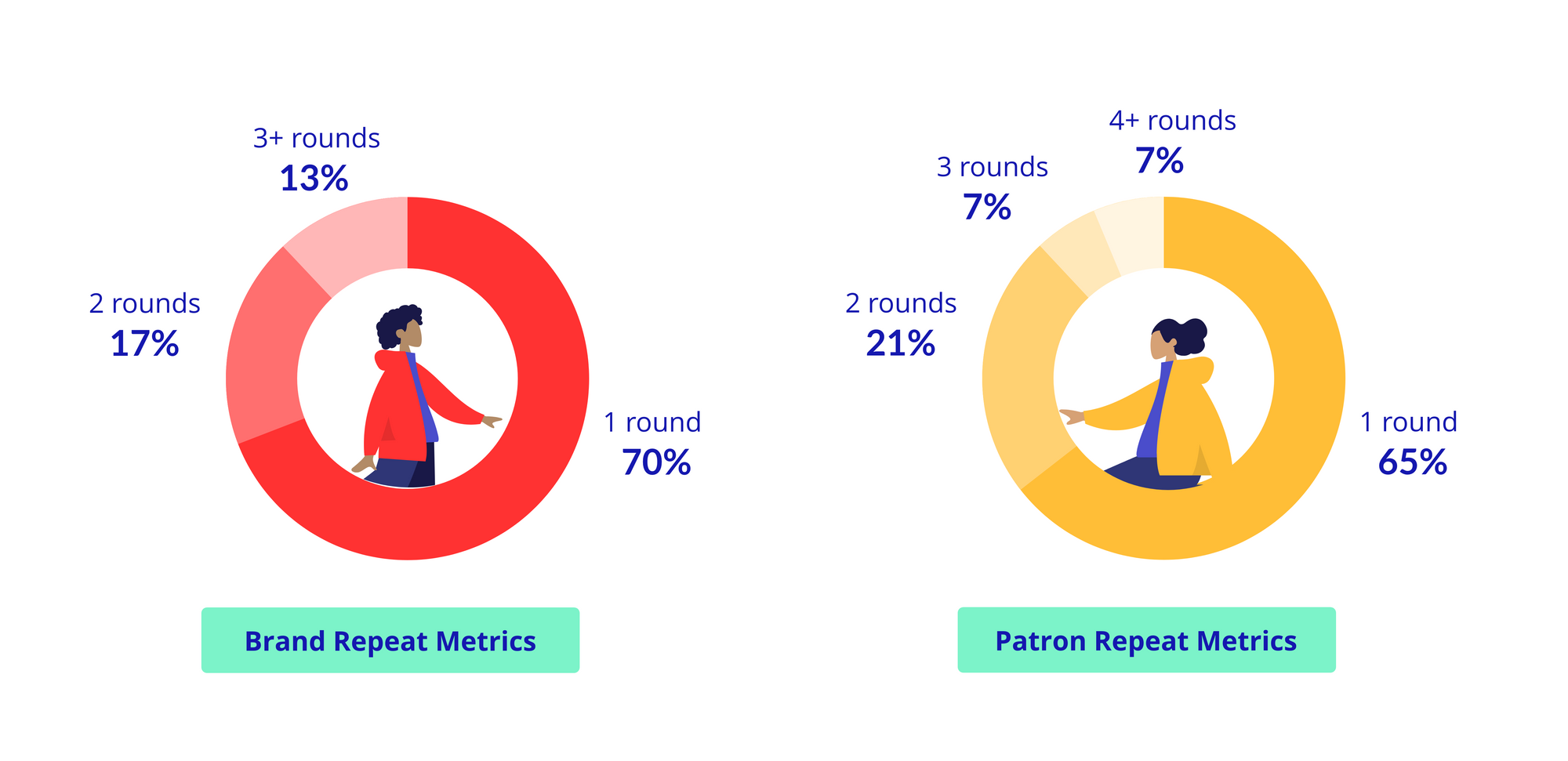

- Repeat Metrics - are your customers coming back for more? How often does this happen? The higher this metric, the more value people see in your product.

- Word of mouth - how high is the word-of-mouth around your product? A high word of mouth is arguably the best and earliest indicator of a product-market fit.

- User growth - How fast is your user base growing?

Once you've achieved these basic signs, your model begins to function as a smooth economic engine. We are seeing some early signs of a product-market fit:

Since November 2020,

- Each consecutive month has been larger than the last in terms of capital deployment.

- Brands and patrons have repeatedly referred more brands & patrons to Klub, and our investor [patron] registrations have increased by 22% every month since 2019.

- Our customers haven't just shown satisfaction, they've outright appreciated the model & the way Klub works - something we like to call an emotional product-market fit.

We derive a deep sense of joy from watching brands scale, and our North Star Metric has always been the amount we disburse to brands, but since we're a marketplace, we also have to look very closely at the Check Metric [as Gokul Rajaram puts it] - the amount returned to investors.