Maximising your funding opportunities: A founder's ultimate handbook to Revenue Based Financing

Thu Aug 24 2023

5 min read

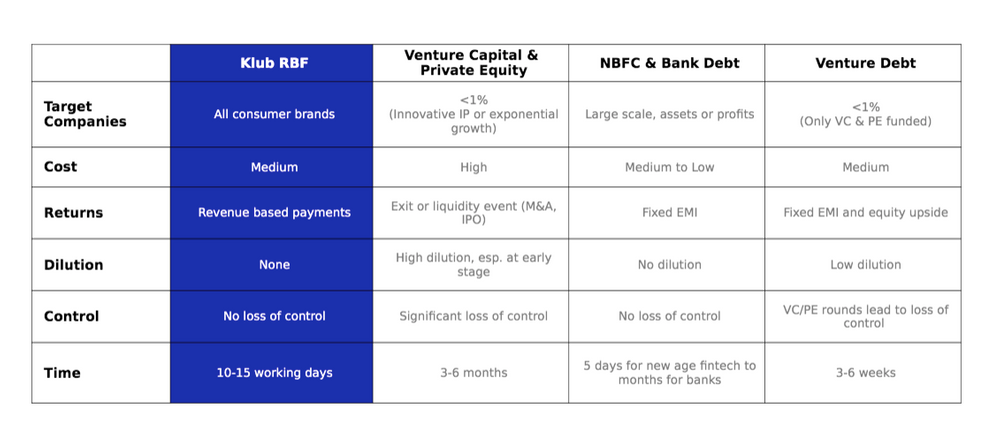

As a founder, securing funding is essential to the success of your business. While traditional financing options like venture capital and bank loans may be popular, Revenue Based Financing (RBF) is becoming increasingly popular.

RBF allows founders to receive funding based on their company's revenue instead of giving away equity. It means you can maintain control of 100% of your business while accessing the funds you need to grow.

Discover if Revenue Based Financing is the right choice for you!

Take a closer look at this comprehensive guide to assess your eligibility as a founder.

What is Revenue Based Financing?

It is a flexible and dilution-free form of raising capital for SMEs (small and medium enterprises) and early-stage startups in sectors from investors who receive a percentage of the company’s ongoing gross revenues in exchange for the money they invested.

Investors receive a regular share of the business's future revenues until a multiple of the principal investment has been paid.

What do RBF companies look for before investing?

RBF companies look at several parameters like cash flow, revenues, operating margins, growth potential, and scalability, among others, as a part of their audit or due diligence.

They leverage online sales, marketing, credit and taxation data to build a holistic picture of the company’s creditworthiness.

Once convinced, the lender will forward the agreed-upon amount to the borrower’s account.

Revenue Based Financing vs. Debt Financing

Revenue Based Financing seems similar to debt financing due to regular repayments of their initially invested capital.

Instead, the repayments are calculated using a particular multiple, resulting in higher returns than the initial investment. Also, in revenue-based financing, a company may or may not be required to provide collateral to investors. This can vary based on the RBF platform you consider for your funding.

Key factors to consider to assess your eligibility for RBF

So, how do you know if revenue-based financing is right for your business?

1. Consistent Revenue: RBF best suits companies with a steady and recurring revenue stream. RBF may not be the best option if your business is still in its early stages and has yet to have a consistent revenue stream.

2. Growth Potential: While RBF can provide funding for current operations or working capital, it's also essential to consider the growth potential. If your business has a high growth potential, RBF can provide the necessary funding to help you reach your goals.

3. Timeframe: RBF typically requires a shorter repayment period than traditional financing options. If your business needs funding quickly and can repay the funds within a shorter time frame, RBF may be the best option.

4. Cost: While RBF can be a great way to access funding without giving up equity, it's essential to consider the cost. RBF typically comes with a higher interest rate than traditional financing options, so weighing the pros and cons before deciding is crucial.

Note: Although RBF is more expensive, it comes with added benefits of being fast and flexible.

5. Gross margins: A company that aims to resort to revenue-based financing must have solid gross margins to ensure its ability to repay the investment.

6. Geographical location: Many companies that offer revenue-based financing only fund businesses within their operating regions. You may be immediately disqualified if your company is far from a potential funding partner.

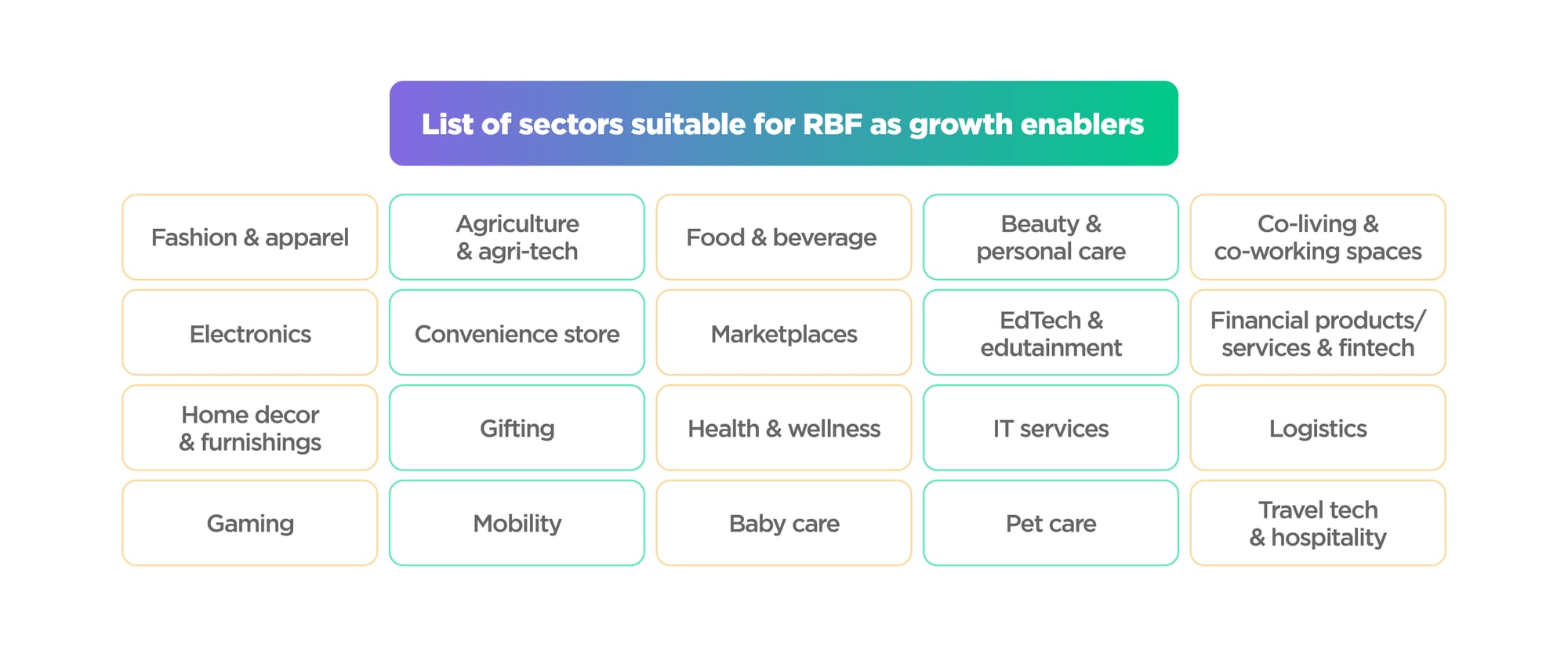

7. Target sectors: Find a revenue-based financing company that covers your business sector for the best growth partner match. Knowing their specialities is crucial in meeting eligibility requirements and finding the right fit.

8. Terms of funding: Before signing a term sheet, it's essential to ask if there are any limitations on how the funding can be used and if there are different rates for funding based on its purpose.

For eg: Klub provides funds to support growth, and working capital needs with no restrictions on using funds.

How does revenue-based financing stand out?

1. RBF is not your traditional loan: RBF is a debt offered to start-ups and SMEs but is not as structured as a typical bank loan.

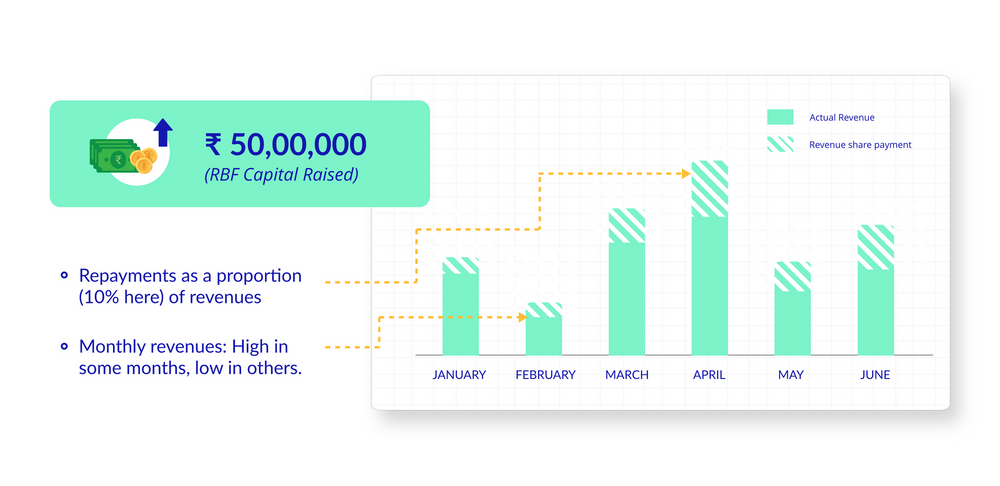

2. Flexible repayment: In RBF, investors get a share of the business’ monthly revenues. This signifies that if a company earns a higher monthly income, the investor gets back a greater share.

With flexible repayments, the investor gets higher when business is higher or lower when biz is low. The repayment is always in line with the business's revenue growth. This repayment includes the principal and returns decided upon during the investment time. Companies can repay the borrowed sum + revenue share within a predetermined period or earlier, depending on their revenue scale.

3. No equity sharing: To access revenue-based financing, a company need not dilute equity to meet working capital requirements. Borrowers must repay the debt with a profit share between 2% and 15% instead of paying EMIs or equity dilution.

4. No collateral required: There is no need to pledge collateral as securities for revenue-based financing, making it a less risky proposition for borrowers. However, this may vary depending on the RBF platform and the amount of funds you choose to borrow.

5. Absolute profitability is not absolute: Revenue-based financing is highly attractive for businesses that can carefully assess and predict their revenue flow. Though a start-up may not be absolutely profitable, they do have a regular stream of income.

Sectors that are a perfect fit for Revenue Based Financing

Businesses with proven business models that don’t require excessive cash burn. These are fast-growing businesses with solid fundamentals, founded by a new generation of entrepreneurs, but they would neither qualify for VC funding nor a business loan for startups.

Here is the exhaustive list of sectors that can consider Revenue Based Financing as their growth enablers.

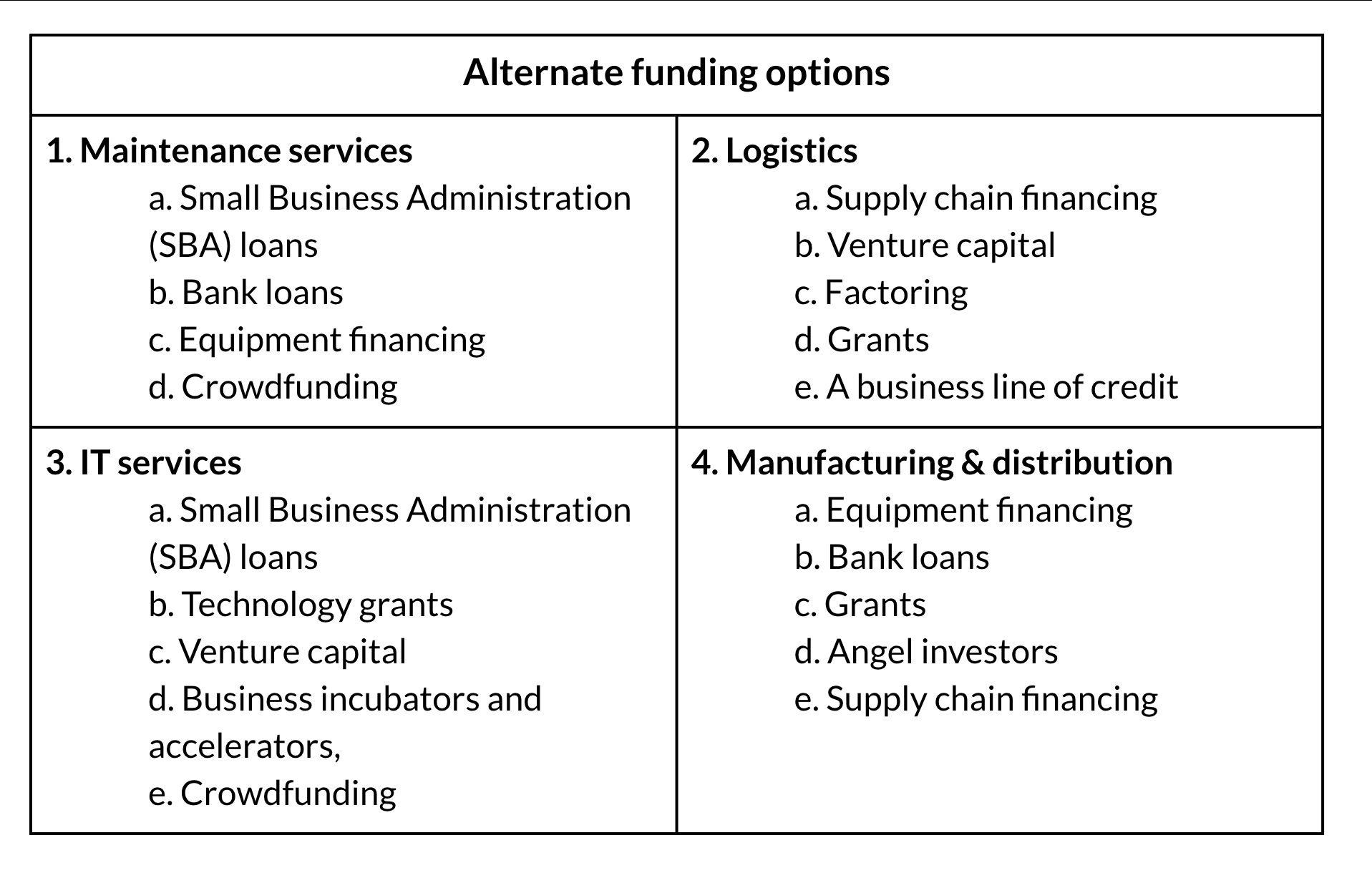

Industry sectors not suitable for Revenue Based Financing

There are specific industry sectors that are incompatible with Revenue Based Financing. This type of financing may not be suitable for businesses that operate in these sectors due to various factors such as unpredictable revenue streams, high levels of competition, or regulatory restrictions.

It is essential to carefully consider the nature of a business and its industry before pursuing this type of financing.

1. Maintenance services

2. Logistics

3. IT services

4. Manufacturing & distribution

Alternate funding options

Conclusion

If you've determined that RBF is the right option for your business, it's essential to thoroughly research potential lenders and understand the terms of the agreement. Maximising your funding opportunities through revenue-based financing can take your business to the next level while maintaining control and ownership.

In conclusion, Revenue Based Financing offers a compelling alternative to traditional debt funding and equity-based options like venture capital. By considering factors such as consistent revenue, growth potential, and cost, you can determine if RBF aligns with your business needs and goals.