Brands Corner

Revenue Based Financing - D2C's new BFF

Thu Mar 04 2021

4 min read

Growth capital is a concept only a few businesses have been attuned to thus far - that is because it has been an expensive and time-consuming process. Equity investors need to evaluate your potential to return 10x-20x of their investment while banks need to see profitability and go through their inexhaustible checklists. However, new-age financing options have changed the game so that younger, revenue-generating businesses can raise capital to fuel growth. Enter: Revenue Based Financing!

In the last couple of years, RBF or Revenue Based Financing has become the topic of conversation for up-and-coming startups across genres - while RBF is used as a financing option for SaaS startups, more & more D2C brands are adopting RBF for growth capital in India.

So, what is Revenue Based Financing?

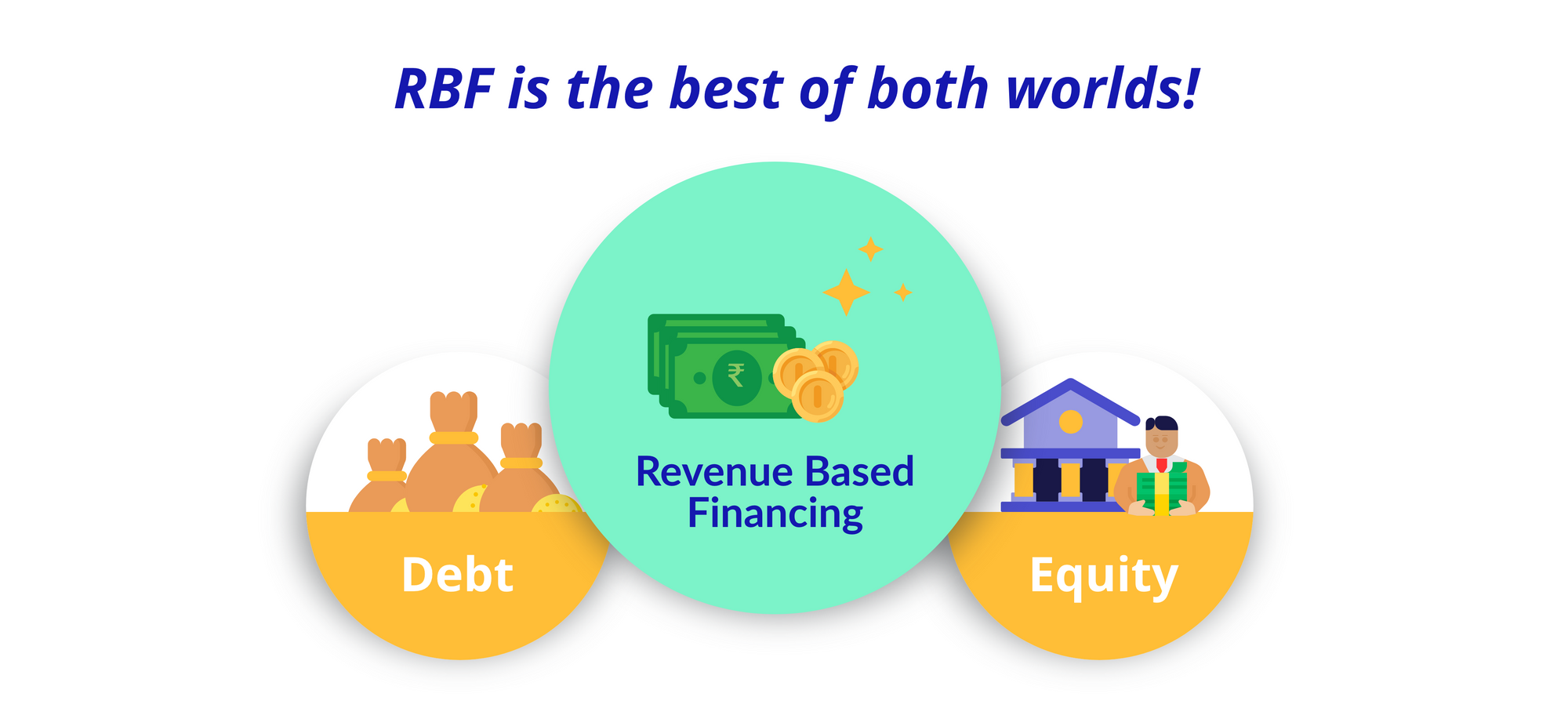

RBF is a model which has the best features of debt and equity financing. It is growth financing where repayments are a percentage of revenues. Revenue based financing enables a company to share a fixed percentage of future revenues with an investor in exchange for capital. This is different from bank loans in that there are no personal guarantees involved, and you can get access to funds without having to deal with restrictive EMI payments since the quantum is a function of your revenues, instead of your balance sheet. It's different from equity financing [angel investment or venture capital] in that the business does not have to dilute any of its equity in exchange for capital - which also means you retain complete control of your business - and the capital gets transferred to your bank account in days instead of months!

So, how exactly does RBF work?

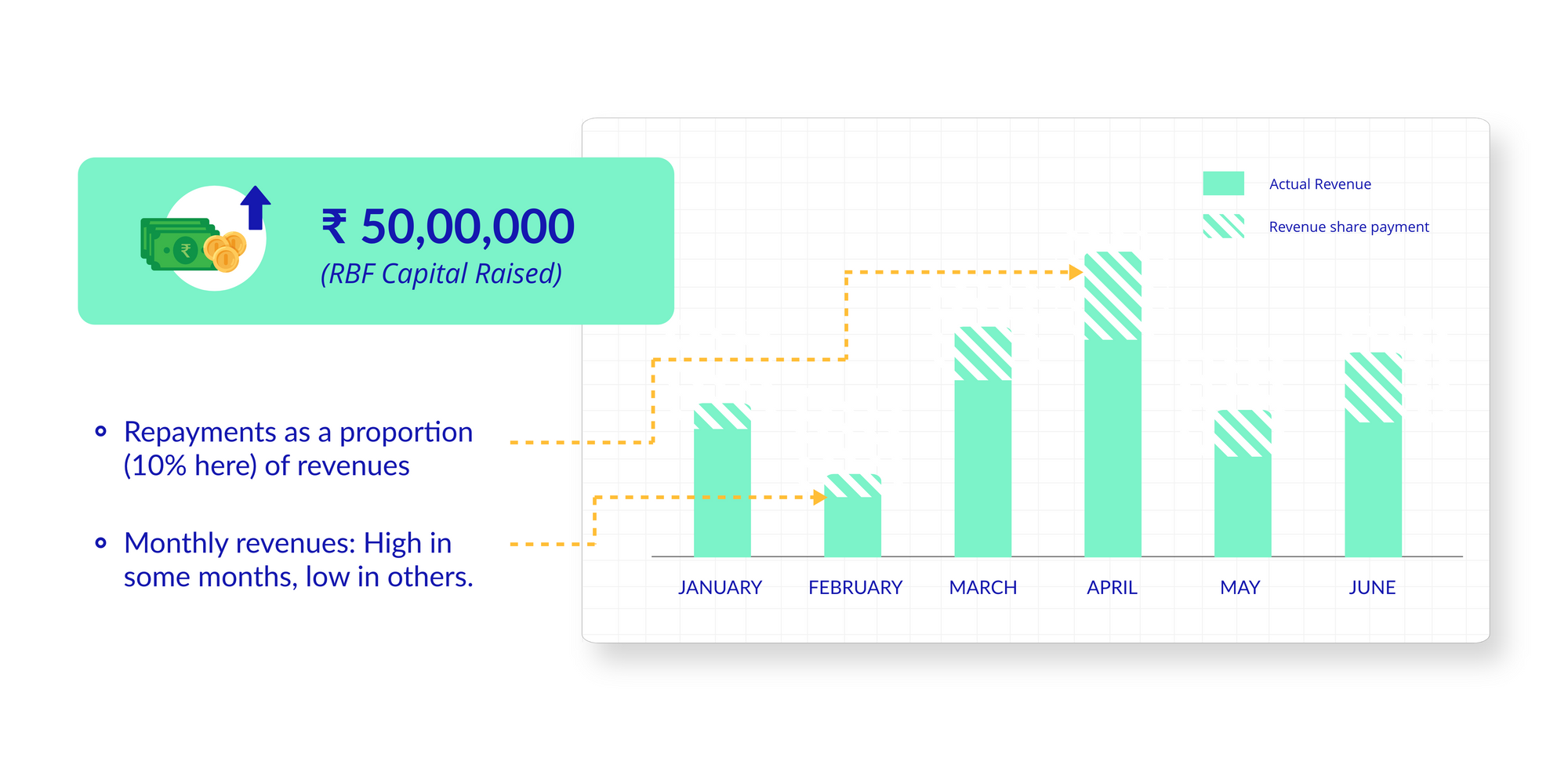

Let’s say you run a business, with monthly revenues of Rs.50 lakhs on average, and are therefore expecting about Rs. 3 crores in revenues over the next 6 months.

You opt to raise Rs. 50 lakhs for your growth needs, be it marketing, inventory, or capex . Let's say this comes at a revenue share of 10% [the revenue share is usually between 2%-15%] and a fixed yield of 10%.

In this case, you make your repayments to the investor at a revenue share rate of 10% - this means that 10% of your revenues are owed to the investor - till you have paid back Rs. 55 lakhs to the investor. Once you have paid back Rs. 55 lakhs, the investment is over!

Actual revenues [6 months] = Rs 3 cr | Financing raised = Rs 50,00,000 | Repayments = Rs 55,00,000 | Cost of Capital = Rs 50,000 or 10%

That's it! Your returns are capped at 10%, which means if your business does well, you end up paying off the loan before the tenure of 6 months.

RBF is increasingly becoming the go-to fundraising method for entrepreneurs across industries looking to fund growth expenses. Here's why RBF could be your new BFF:

RBF is excellent for D2C businesses. Since sales volumes can be unpredictable in a D2c business model, RBF fits in perfectly with its revenue-share aspect. You pay more in the good months, and less in the lean months, thereby escaping the risk of committing to fixed repayment amounts.

Now that you know how RBF could be great for you, let's figure out what's the stage at which your business should raise growth capital via RBF:

- You have strong unit economics & therefore good gross margins.

- You have a good revenue profile and are expecting constant if not growing revenues. [Side note: Klub offers 3 plans based on your revenues & capital needs. The plans start at monthly revenues as low as Rs. 5 lakhs].

- You need capital for recurring needs: marketing, inventory, capital expenditures in a way where the input of capital has a correlation to the output. This also implies that RBF should NOT be used for salaries, R&D, or product development - these don't guarantee month-on-month revenues since there is no input & output correlation.

RBF can be raised at any stage of your business as long as you're seeing consistent, if not growing, revenues. Whether you're a large business with multiple investors on your cap table or a small bootstrapped business, RBF can be deployed for fast growth. Businesses tend to use RBF for the following:

- Marketing & advertising spends.

- Inventory expansion.

- Expansion into a new market, a new region [nationally or internationally], or a new product line.

- Capital Expenditure spends.

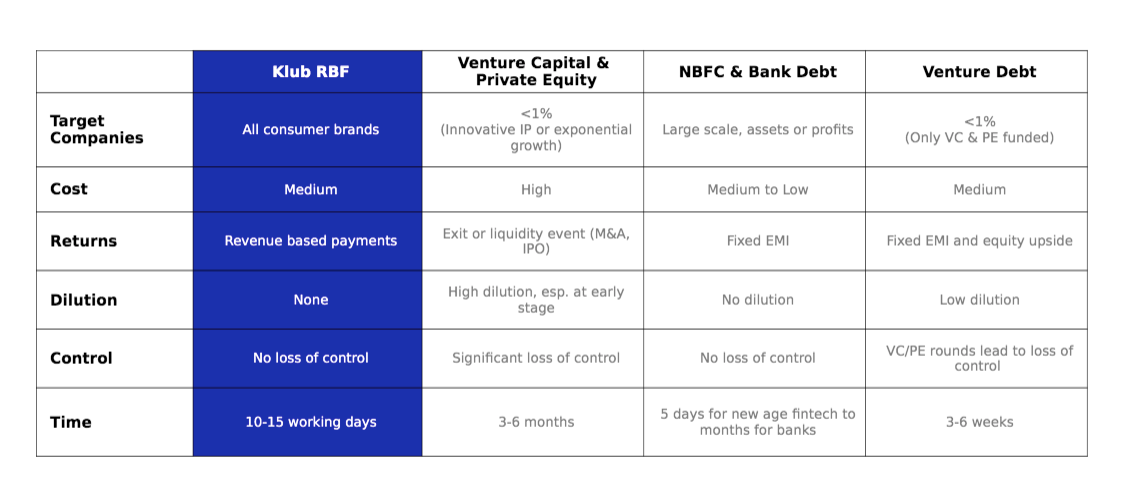

Klub's RBF vs. other fundraising avenues:

TL;DR:

- Growth Capital is capital injected into a business for expansion - of inventory, operations, advertising spends, or to enter into new markets.

- Raise growth capital when you have strong unit economics and fairly stable revenues.

- RBF is the best of the equity & debt worlds, and makes an ideal fundraising method for growth capital needs. It's skin-in-the-game capital for your business - it's fast, flexible, accessible, and you lose ownership of your business.