How Can E-commerce Businesses Leverage Revenue Based Financing?

India is the 8th largest globally and is expected to hit the $1 Tn market size by 2030. The ever-growing D2C brands and thousands of merchants selling via marketplaces play an important role in catering to India’s e-commerce boom.

Whether a company sells via D2C route or marketplaces, several business owners face problems with e-commerce funding. While the funding principles stay the same, traditional sources of e-commerce startup funding are no longer enough for founders. The lack of flexibility in bank loans and dilution of ownership with e-commerce venture capital often become counterproductive for the growth plans of these businesses. How does Revenue Based Financing fit in this picture?

- Working capital - Maintaining sufficient working capital is essential for inventory, marketing, and operational expenses. Revenue Based Financing can help businesses maintain liquidity for high ROI working capital spends.

- Expansion - Be it new products or delivery radius, expansion can be a capital intensive process for e-commerce businesses and it can be managed seamlessly through Revenue Based Financing without fixed EMIs piling up for the brand.

- Seasonal promotions - Peak sale durations like festive season, new year, marketplace sale events, etc. impact inventory requirements of e-commerce businesses. To make the most of this seasonal demand, Revenue Based Financing can help e-commerce retailers maintain increased inventory levels throughout the year.

This is how Revenue Based Financing (RBF) can help e-commerce businesses grow at their own pace through its key differentiating features:

- Fast - As compared to the long procedures associated with both e-commerce business loans and raising equity-led venture capital, Revenue Based Financing rounds by Klub can be processed in time as low as 48 hours. Businesses have the option to seamlessly raise up to ₹30 Cr.

- Fair - Without any tedious pitching and investor appeasement, founders can raise funding for e-commerce business by only sharing business related data.

- Flexible - Unlike fixed EMIs that pile up and affect businesses cash flow, Revenue Based Financing offers founders the luxury of flexible repayments that are a percentage of their monthly sales. In Revenue Based Financing a business pays less during lean months and more during high growth months, ultimately paying it off sooner than the whole tenure.

- Founder friendly - Funding usually comes with its share of equity dilution and founders lose a stake in their own business for capital. This is not the case with RBF because we do not take any equity against the funds brands raise with us.

- Frequent - Businesses that raise Revenue Based Financing repay it before their total tenure such that more than 70% of these businesses raise repeat rounds in just 3-5 months after their first round.

Venture capital in the Indian e-commerce sector declined by 63% in 2022! Amidst this and a global funding winter looming large, raising capital has increasingly become challenging for D2C brands.

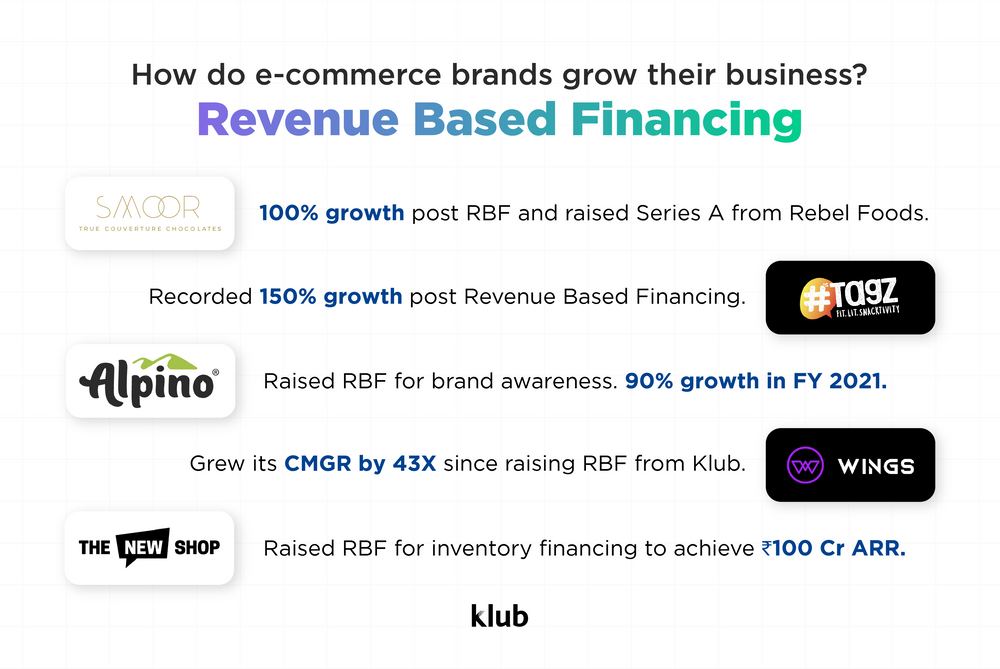

Amidst this newer, faster, and more founder-friendly ways to raise e-commerce funding are changing the game for the sector. Revenue Based Financing is enabling D2C brands with a recurring revenue stream to raise capital seamlessly for inventory, marketing, operational expenses, and growth.

In less than 48 hours your e-commerce or D2C brand can raise up to ₹30 Cr from Klub.